2017

MENU

EKF ANNUAL REPORT 2017

The Chairman’s report

With a net profit of DKK 598 million, 2017 was a record year for EKF. A record attributable to the fact that fewer projects required new provisions for losses. All in all, a sign that the export markets are picking up.

EKF is Denmark’s export credit agency

Ever since 1922, the object of EKF has been to support Danish exports and to create growth and jobs in Denmark. EKF makes it possible for Danish companies to realise their export dreams by providing export credits, working capital guarantees and loans and thus enabling them to finance their activities and cover commercial and political risks in the export markets.

Financial statements

Increasing activity in distant markets

Recovery affecting

demand for EKF

In 2017, the world economy really began to pick up again, and the banks increased their lending. This means that the banks are now financing far more export activities in the EU and the OECD, and EKF consequently issued fewer new guarantees in 2017 than in the previous year in money terms. However, a much larger number of corporates used EKF’s solutions than was the case in 2016.

After the end of the financial crisis, Danish exporters are increasingly focusing on more exotic export markets in Africa, Asia and Latin America. These are classic export credit countries in which the banks – unlike EKF – are not always willing or able to get involved.

EKF finances Danish exporters and their buyers – also in countries with high levels of political, financial and project-related risk. A case in point is Iran, where the UN and the EU have lifted sanctions after more than ten years. Another case in point is Ethiopia, where major infrastructure projects are underway. And a third case in point is Argentina, which was racked by a debt crisis, but is currently investing strongly in green energy.

With a net profit of DKK 598 million, 2017 was a record year for EKF. A record attributable to the fact that fewer projects required new provisions for losses. All in all, a sign that the export markets are picking up.

EKF issued new export credits, working capital guarantees and loans worth DKK 11.5 billion in 2017, bringing EKF’s total administered portfolio to just under DKK 71 billion with equity amounting to DKK 7.6 billion.

In 2017, EKF helped Danish exporters secure contracts worth DKK 17 billion. Thus, EKF contributed more than DKK 6 billion to GDP in the year under review and helped to create and retain more than 8,000 jobs in Denmark.

EKF is owned by the Danish state, and as part of the government’s North Sea agreement of March 2017, we were asked to pay dividend to our owner in the past year. This led to a change in legislation in December, meaning that EKF will pay just over DKK 1 billion in dividend to the Danish state over the coming years. We contributed the first DKK 125 million in 2017, and EKF expects to contribute another DKK 140 million in 2018. Despite the dividend to our owner, EKF’s risk appetite remains unchanged, and we still have ambitions to use the remaining profit to help even more exporters.

Exports are among the key drivers of Denmark’s growth, and ’Vækst med omtanke’ (Prudent growth) is the title of EKF’s new strategy that was adopted in 2017. This strategy sets the direction for the export credit initiatives of the Danish government. Its objective is to ensure that both large Danish corporates and small and medium-sized enterprises step up their exports in the coming years.

Prudent growth concerns EKF’s activities in both Denmark and the countries in which Danish exporters are operating. We need to exercise care with regard to exporters’ special need for financing, and we must act with care in respect of their customers and the projects they start up around the globe. But it is also about exercising care with regard to credit rating when working with public funds like we do. And we must always keep in mind the impacts on the environment, the employees and the population in the countries we are exporting to.

EKF is there to help exporters implement their business growth plans. Including when they are venturing into new, high-risk markets, or when they need complex, customised financing solutions. In the coming years, we aim to be there for exporters to such an extent as to increase the number of new guarantees we issue even more.

All this would not be possible without the untiring commitment of EKF’s employees and without the close cooperation with our customers, the banks and our owners in the Danish Ministry of Industry, Business and Financial Affairs. I would like to extend my special thanks to them all.

Christian Frigast

Chairman of the Board of Directors

EKF is there to help exporters implement their business growth plans. Including when they are venturing into new, high-risk markets.

CHRISTIAN FRIGAST

Chairman of the Board of Directors at EKF

Financial highlights

-

Net profit

-

598

-

DKK m

-

-

-

Operating income

-

812

-

DKK m

-

-

-

Portfolio

-

70,959

-

DKK m

-

-

-

New guarantees

-

11,507

-

DKK m

-

-

-

Customers

-

769

-

Net profit/loss

for the year

The net profit for 2017 amounted to DKK 598 million.

Net profit for 2017

for own account","isSum":false,"y":550,"color":""},{"name":"Basic earnings,

lending activities","isSum":false,"y":275,"color":""},{"name":"Guarantee commission","isSum":false,"y":22,"color":""},{"name":"Claims expenses/

write-downs of loans","isSum":false,"y":-19,"color":"#9b9b9b"},{"name":"Administrative expenses","isSum":false,"y":-179,"color":"#9b9b9b"},{"name":"Exchange rate adjustments

and net financials","isSum":false,"y":-51,"color":"#9b9b9b"},{"name":"Net profit/loss for 2017","isSum":true,"y":0,"color":"#005475"}],"_colorIndex":0}],"xAxis":{"categories":[],"title":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"rotation":-45,"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":0},"yAxis":{"categories":[],"title":{"text":"DKK million","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"#ddd","tickColor":"#ddd","tickInterval":100},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#000","fontFamily":"Arial, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#000","fontFamily":"Arial, sans-serif"}},"legend":{"enabled":false,"layout":"horizontal","align":"center","padding":10},"tooltip":{"enabled":false,"pointFormat":"{point.y}","valueSuffix":" Mio. kr.","shadow":false,"backgroundColor":"#ffffff","borderColor":"#ffffff"}}

Operating income

EKF’s total operating income before administrative expenses amounted to DKK 812 million for 2017, including DKK 553 million from insurance activities and DKK 259 million from lending activities.

Total operating income before administrative expenses

before administrative expenses","data":[-154,331,259],"_colorIndex":0},{"name":"Technical result before

administrative expenses","data":[375,269,553],"_colorIndex":1}],"xAxis":{"categories":["2015+","2016+ ","2017"],"gridLineColor":"#ddd","gridLineWidth":0,"title":{"text":" ","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":0},"yAxis":{"categories":[""],"gridLineColor":"#ffffff","gridLineWidth":1,"title":{"text":"DKK million","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value:,.0f}"},"lineColor":"rgba(0, 0, 0, 0)","lineWidth":0,"tickColor":"rgba(0, 0, 0, 0)","tickInterval":200},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"legend":{"enabled":true,"layout":"vertical","align":"right","verticalAlign":"top","itemMarginTop":20,"padding":10,"itemStyle":{"color":"#636362","fontWeight":"normal","fontFamily":"Verdana, sans-serif","fontSize":12}},"tooltip":{"enabled":false,"shared":false,"pointFormat":"{point.y}","valueSuffix":" mio. kr.","shadow":false,"backgroundColor":"#ffffff","borderColor":"#ffffff"}}

+ Result of lending activities for 2015 included a negative value adjustment of DKK 416 million; 2016 saw a positive value adjustment of DKK 118 million.

Portfolio

EKF’s total portfolio amounted to DKK 70,959 million in 2017. It consists of EKF’s guarantee exposure, loans and offers issued.

EKF’s guarantee exposure after reinsurance amounted to DKK 38,248 million and loans amounted to DKK 12,627 million, i.e. DKK 50,875 million in total.

Guarantee exposure and loans by sector

Wind is EKF’s largest business area. A look at the breakdown of EKF’s guarantee exposure and loans shows that wind projects account for DKK 34 billion.

Development in export credits, working capital guarantees and loans less reinsurance

capital guarantees and

loans at 31.12.2016","isSum":false,"y":55.3,"color":"#005475"},{"name":"Repayments on and reductions

in guarantees and loans","isSum":false,"y":-6.5,"color":"#9b9b9b"},{"name":"Repayments","isSum":false,"y":-3.5,"color":"#9b9b9b"},{"name":"Other changes","isSum":false,"y":-3.7,"color":"#9b9b9b"},{"name":"Net reinsurance","isSum":false,"y":-0.6,"color":"#9b9b9b"},{"name":"Exchange rate effects","isSum":false,"y":-2.8,"color":"#9b9b9b"},{"name":"New loans","isSum":false,"y":1,"color":"#c4c5c5"},{"name":"New project financing

guarantees","isSum":false,"y":3.8,"color":"#c4c5c5"},{"name":"New buyer credit

guarantees","isSum":false,"y":5,"color":"#c4c5c5"},{"name":"Other new guarantees","isSum":false,"y":2.8,"color":"#c4c5c5"},{"name":"Export credits, working

capital guarantees and

loans at 31.12.2017","isSum":true,"y":0,"color":"#005475"}],"_colorIndex":0}],"xAxis":{"categories":[],"title":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"rotation":-45,"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":1},"yAxis":{"categories":[],"title":{"text":"DKK billion","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"#ddd","tickColor":"#ddd","tickInterval":10},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#000","fontFamily":"Verdana, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#000","fontFamily":"Verdana, sans-serif"}},"legend":{"enabled":false,"layout":"horizontal","align":"center","padding":10},"tooltip":{"enabled":false,"pointFormat":"{point.y}","valueSuffix":" DKK billion","shadow":false,"backgroundColor":"#ffffff","borderColor":"#ffffff"}}

EKF’s guarantee exposure fell by DKK 4.4 billion compared to 2016. The fall was attributable to large prepayments and reductions not offset by new guarantees in 2017.

Guarantee exposure and loans by region

Western Europe remains EKF’s largest region. Guarantee exposure and loans to Western Europe amount to DKK 23.8 billion, up from 23.3 billion at end-2016. Guarantee exposure and loans to North and South America, Eastern Europe and CIS as well as Asia/Pacific decreased relative to the preceding year. Similarly, guarantee exposure and loans to the Near and Middle East, including Turkey, and to Africa increased.

New guarantees

In 2017, EKF’s new guarantees amounted to DKK 11,507 million.

New guarantees

food technology","data":[0.69,1.14,0.46,0.63],"_colorIndex":1},{"name":"Biomass","data":[0.29,3.1,0.22,0.01],"_colorIndex":2},{"name":"Wind","data":[8.35,7.6,11.1,7.08],"_colorIndex":3}],"xAxis":{"categories":["2014","2015","2016","2017"],"gridLineColor":"#ddd","title":{"text":" ","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":0},"yAxis":{"categories":[],"gridLineColor":"#ffffff","gridLineWidth":1,"title":{"text":" DKK billion","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"#ddd","tickInterval":2},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"legend":{"enabled":true,"layout":"vertical","align":"right","verticalAlign":"middle","itemMarginTop":20,"padding":10,"itemStyle":{"color":"#636362","fontWeight":"normal","fontFamily":"Verdana, sans-serif","fontSize":12}},"tooltip":{"enabled":true,"shared":false,"pointFormat":"{point.y}","valueSuffix":" DKK billion","shadow":true,"backgroundColor":"#ffffff","borderColor":"#ffffff"}}

Customers

EKF had a total of 769 customers at the end of 2017.

Development in the number of customers

+ Unlike previous years, 58 customers from short-term reinsurance were included in 2017.

In the past five years, EKF has seen a pronounced increase in its customer base. The increase is driven by small and medium-sized enterprises, in particular.

Customers by sector, 2017

EKF’s customers are distributed across a wide range of sectors. In 2017, industrial production accounted for just over one quarter.

Financial highlights and

ratios for 2017

5-year overview

| DKK MILLION | 2017+ | 2016+ | 2015+ | 2014 | 2013 |

| Gross premium income | 890 | 1,202 | 874 | 1,613 | 1,650 |

| Technical result before administrative expenses | 553 | 269 | 375 | 153 | 568 |

| Result of lending activities before administrative expenses | 259 | 331 | -154 | - | - |

| Net profit/loss for the year | 598 | 467 | 162 | 378 | 453 |

| New export credits, working capital guarantees and loans | 11,507 | 13,885 | 14,098 | 15,222 | 16,795 |

| Technical provisions | 3,800 | 4,991 | 4,820 | 5,937 | 4,136 |

| Equity | 7,612 | 7,140 | 6,674 | 6,453 | 6,075 |

| Proposed dividend++ | 140 | 125 | - | - | - |

| Balance sheet total | 26,834 | 30,099 | 30,318 | 12,755 | 10,384 |

| Guarantee exposure after reinsurance | 38,248 | 41,515 | 38,591 | 56,359 | 52,675 |

| Reinsurance exposure | 12,631 | 12,589 | 10,397 | 9,379 | 6,888 |

| Loans | 12,627 | 13,782 | 14,549 | - | - |

| Conditional offers exposure | 7,453 | 14,952 | 9,313 | 16,078 | 10,439 |

| Administered portfolio+++ | 74,456 | 86,792 | 77,426 | 86,898 | 74,914 |

| Average number of employees | 124 | 124 | 119 | 109 | 96 |

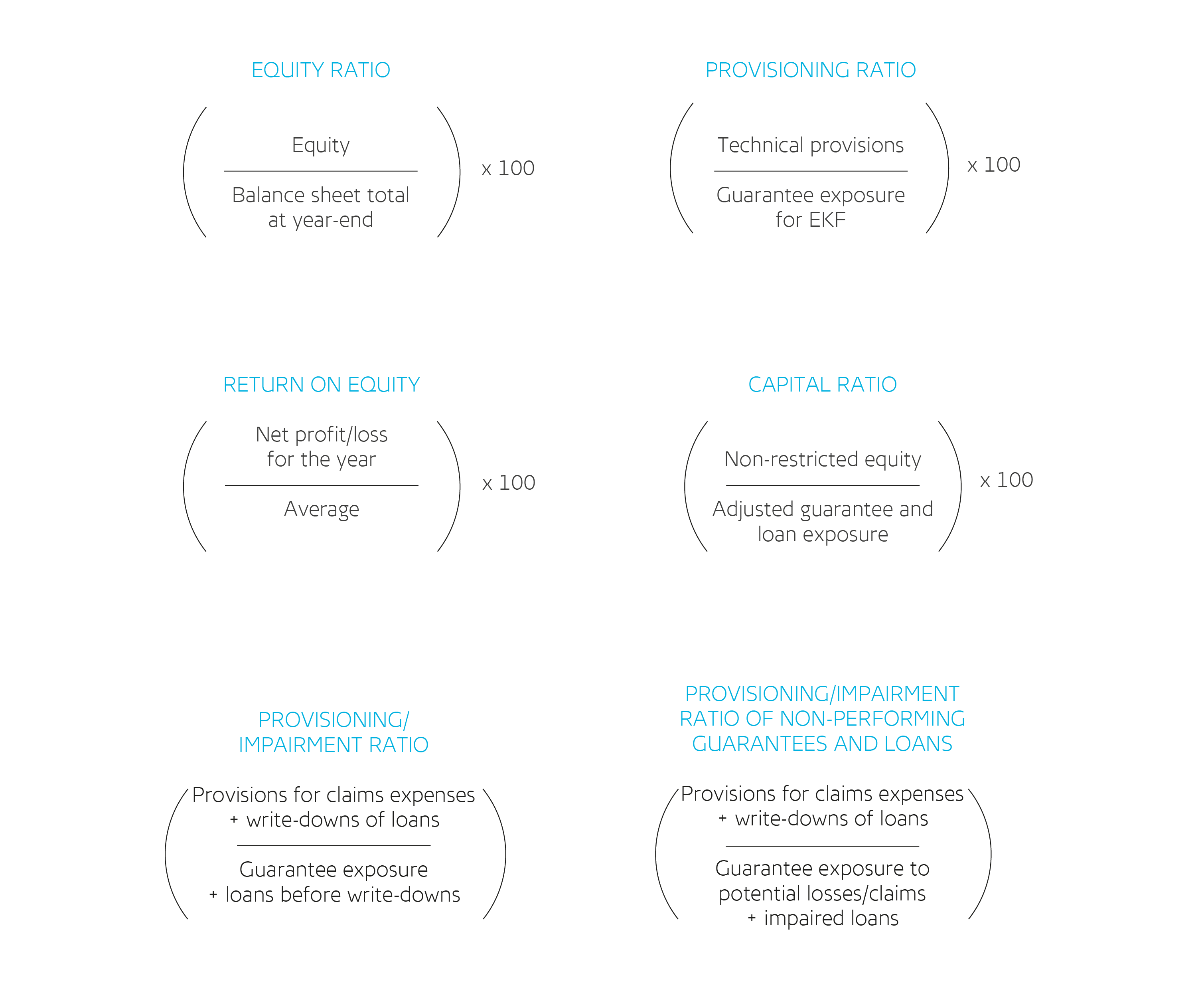

| Ratios, per cent | |||||

| Equity ratio | 28.4 | 23.7 | 22.0 | 50.6 | 58.5 |

| Provisioning ratio | 9.9 | 12.0 | 12.5 | 10.5 | 7.9 |

| Proportion of non-performing guarantees and loans | 3.1 | 6.1 | 6.5 | - | - |

| Provisioning/impairment ratio of non-performing guarantees and loans | 55.3 | 47.0 | 48.3 | - | - |

| Provisioning/impairment ratio | 1.7 | 2.9 | 3.1 | - | - |

| Return on equity | 8.1 | 6.8 | 2.5 | 6.0 | 8.0 |

| Capital ratio | 9.4 | 6.9 | 8.0 | 7.0 | 7.3 |

| Administrative expenses in proportion to administered portfolio | 0.240 | 0.203 | 0.223 | 0.188 | 0.202 |

| Number of customers in proportion to the number of employees | 6.20 | 5.65 | 5.84 | 5.87 | 5.72 |

+ The merger of the Export Lending Scheme and EKF was implemented with effect from 1 January 2016. The overview is adjusted to the merger for 2015 and 2016, but not for previous years.

++ Dividend is distributed in the financial year following the approval by the Danish Minister for Industry, Business and Financial Affairs.

+++ Administered portfolio is EKF’s exposures to export credits, working capital guarantees, loans and conditional offers. The calculation includes exposures under the Mixed Credit Programme and investment guarantees issued by the Danish Ministry of Foreign Affairs before 2007. In addition, it includes exposures reinsured by EKF with other export credit agencies or private credit insurance companies.

Definitions of financial highlights and ratios

EKF is

Denmark’s

export credit agency

Ever since 1922, the object of EKF has been to support Danish exports and to create growth and jobs in Denmark. EKF makes it possible for Danish companies to realise their export dreams by providing export credits, working capital guarantees and loans and thus enabling them to finance their activities and cover commercial and political risks in the export markets.

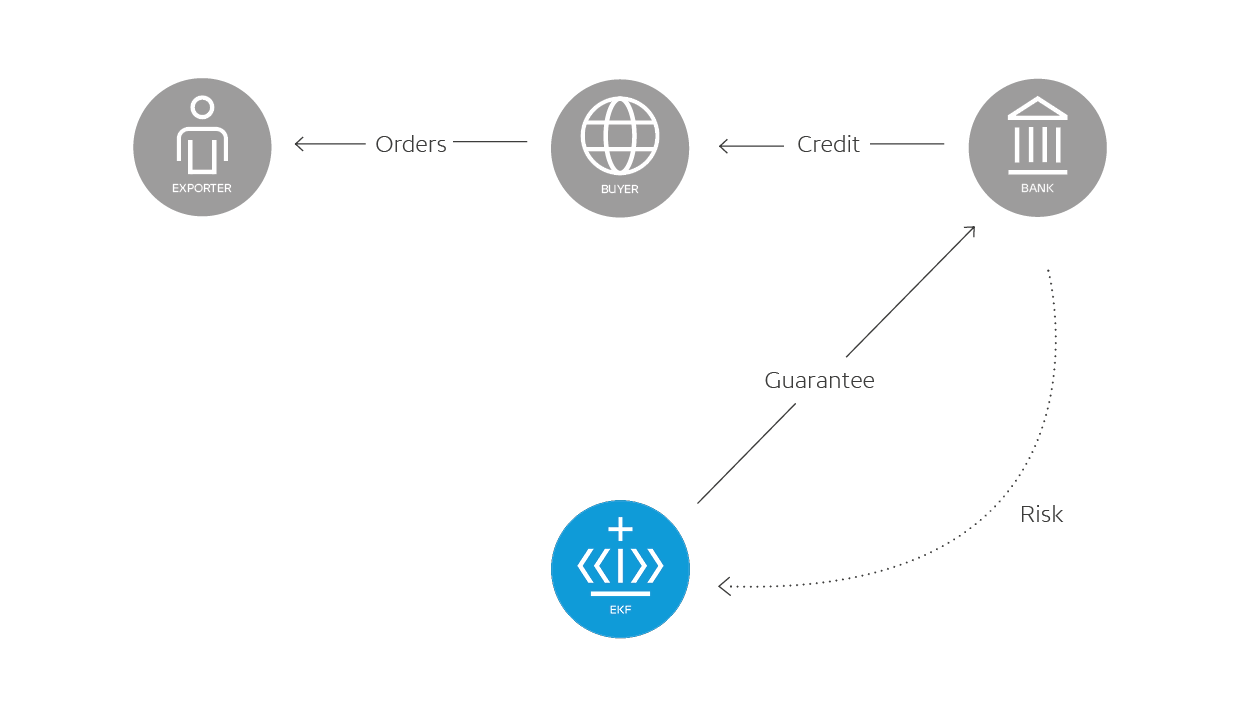

When EKF covers risks, it is easier for exporters and their foreign customers to obtain bank financing for their activities on competitive terms and easier for Danish companies to extend credit to their customers, which is often crucial in order to get a contract. Export credits, working capital guarantees or loans can therefore be decisive for exporters in winning or retaining orders. In 2017, we helped Danish exporters and their sub-suppliers to secure contracts worth DKK 17 billion.

We are the only organisation in Denmark to provide cover for extraordinary export risks that the private market is unable or unwilling to cover. We operate with a long-term perspective and the risk appetite necessary in countries and markets where the political and commercial situation may be uncertain.

In 2017, EKF helped Danish exporters and their sub-suppliers to secure contracts worth DKK 17 billion.

EKF is an important financial partner for Danish companies wanting to:

-

sell more

EKF can offer financing for the foreign customers of Danish companies. This increases sales and strengthens the international competitiveness of Danish exporters. In practice, EKF provides a guarantee for the transaction to a bank. In doing so, we assume most of the risk related to the financing for the exporter’s customer. EKF can also provide export loans directly to a foreign buyer or a project. This is typically done in cases involving major projects. -

finance their business

EKF can expand the scope of exporters and their sub-suppliers for more customers and larger orders by improving their liquidity. To this end, EKF provides security to banks for exporters’ working capital and capital expenditure guarantees. -

protect their exports

EKF can assume the risk when Danish exporters engage in transactions abroad and ensure that they are paid. If something goes wrong, EKF will pay compensation.

Steps in the procedure

EKF stiller garanti for finansieringen til eksportørens udenlandske kunde, så eksportøren kan få flere og større ordrer og derved sælge mere.

EKF stiller garanti for finansieringen til eksportørens udenlandske kunde, så eksportøren kan få flere og større ordrer og derved sælge mere.

One of the ways in which EKF supports Danish exporters is by providing a guarantee for financing of their customers abroad. This enables companies to boost their sales by expanding the scope for more customers and larger orders.

EKF’s business model

EKF is an independent public company. We are owned by the Danish Ministry of Industry, Business and Financial Affairs and managed by our Board of Directors based on the Act on EKF Denmark’s Export Credit Agency.

EKF’s equity and provisions must provide a reasonable basis for our liabilities and future activities. It defines the framework of EKF’s activity level. Under the current rules, our equity must constitute minimum five per cent of our guarantee exposure and loans, please also refer to Significant accounting policies.

Increasing activity

in distant markets

In 2017, EKF saw a pronounced increase in the number of new business transactions for large corporates. Project financing guarantees, buyer credit guarantees, working capital guarantees, bill of exchange and letter of credit financing emphasising that Danish companies are acting globally to a much higher extent and increasingly need to finance transactions in distant markets with high political or commercial risk.

An infrastructure project in Ethiopia, a power plant in Mali, an agricultural project in Belarus and a slaughterhouse project in the Dominican Republic are examples of Danish businesses expanding globally with EKF financing. These projects are dependent on long-term financing and a high risk appetite, and EKF is able to deliver both.

New guarantees to large corporates in high-risk countries

In 2017, EKF provided new guarantees in high-risk countries in the amount of DKK 2.8 billion, which is a much higher amount than in 2015 and 2016.

Countries of the world are divided into risk categories from 0-7. High-risk countries are defined as countries in risk categories 6 and 7.

Wind projects making up a large share

Wind projects make up a large share of EKF’s business. Denmark has three world-leading wind energy companies and many sub-suppliers, which makes wind turbines an important Danish export commodity. A number of large wind turbine projects were realised in 2017 with EKF’s assistance. EKF helped to finance the Walney Extension offshore wind farm project in the UK, among other projects. Construction of offshore wind farms is still mainly concentrated in Northern Europe. The projects are typically very large and financed by a veritable web of financial players.

Onshore wind turbine construction remains cheaper than offshore construction, and today, electricity from new onshore wind farms in many countries are able to compete cost-effectively against fossil fuel and solar energy power plants. This means that onshore wind farms have now become a competitive energy source.

In the past year, EKF was involved in onshore wind turbine projects in Mongolia, Argentina, Mexico and Turkey, among other countries. These are wind turbine projects for which export credit is an important part of the financing, and the fact that EKF is involved in financing the Danish suppliers becomes a key competitive parameter.

A total of DKK 7.1 billion or 61 per cent of new guarantees went to both onshore and offshore wind turbine projects. Offshore projects accounted for 45 per cent of this, while onshore projects accounted for 55 per cent. In 2017, new guarantees decreased by DKK 2.3 billion compared to 2016. The primary reasons were a lower financing requirement for offshore wind projects than in the previous years and several major construction projects in e.g. Africa taking longer than expected.

Development in wind guarantees 2014-2017

A total of DKK 7.1 billion or 61 per cent of new guarantees in 2017 went to wind turbine projects. 45 per cent were offshore projects and 55 per cent were onshore.

wind projects","data":[0,0,0,1],"_colorIndex":0},{"name":"Offshore","data":[4,5,4,3],"_colorIndex":1},{"name":"Onshore","data":[4,3,7,3],"_colorIndex":2}],"xAxis":{"categories":["2014","2015","2016","2017"],"gridLineColor":"rgba(0, 0, 0, 0)","title":{"text":" ","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":1},"yAxis":{"categories":[],"gridLineColor":"#ffffff","gridLineWidth":1,"title":{"text":"DKK billion","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"rgba(0, 0, 0, 0)","tickColor":"rgba(0, 0, 0, 0)","tickInterval":2},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#000","fontFamily":"Verdana, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#000","fontFamily":"Verdana, sans-serif"}},"legend":{"enabled":true,"layout":"vertical","align":"right","verticalAlign":"middle","itemMarginTop":20,"padding":10,"itemStyle":{"color":"#636362","fontWeight":"normal","fontFamily":"Verdana, sans-serif","fontSize":12}},"tooltip":{"enabled":true,"shared":false,"pointFormat":"{point.y}","valueSuffix":" DKK billion","shadow":true,"backgroundColor":"#ffffff","borderColor":"#ffffff"}}

Sub-suppliers with special requirements

Siemens Gamesa, MHI Vestas Offshore Wind and Vestas Wind System A/S all received large orders in 2017, but since the Danish wind industry numbers more than 250 companies spearheaded by Vestas and Siemens, a host of sub-suppliers have also had a share in the Danish wind adventure. Altogether, the companies have more than 30,000 employees and an annual turnover of almost DKK 90 billion.

Many sub-suppliers benefit from the large orders for Siemens and Vestas. EKF has been involved in business transactions with, among others, Bladt Industries, which supplies foundations for offshore wind turbines, with operating systems experts DEIF and with LORC, which is an internationally leading wind turbine test centre in Munkebo on Funen.

EKF aims to get closer to its customers, so direct sales and relation-creating activities were top priorities in 2017, and this will also be the case in 2018. For many years, EKF has had a close working relationship with a large group of Denmark’s largest export companies such as BWSC, Per Aarsleff, FLSmidth, Haldor Topsøe, Skov and Nilpeter. We will continue this working relationship in 2018, and aim to do more business with existing customers and to reach even more.

Development in number of new guarantees for large corporates

The number of new guarantees for large corporates increased by 12 compared to 2016.

EKF guarantee helping to secure the world’s largest offshore wind farm

As the world’s leading public financing partner on wind turbine projects, EKF opted for a new approach in 2017 with its new financing model.

The wind tears across the roaring sea most days of the year, and according to some, it is one of the most windswept areas in the UK. We are around 14 km west of the island of Walney in north-western England. Not the most obvious destination for a beach holiday, but the perfect place for the world’s largest offshore wind farm.

When the Walney Extension offshore wind farm is commissioned in the second half of 2018, it will overtake London Array as the world’s largest wind farm of its kind. With a capacity of 659 megawatts, the wind farm will supply electricity to around half a million British homes.

Construction of wind farms of that magnitude is complex and highly expensive. They require huge loans with long maturities, so it is not possible for a single bank to provide financing. In such cases, financing is dependent on different institutions, including export credit agencies such as EKF, which is the world’s leading public financing partner on wind projects.

In the case of Walney Extension, Ørsted (formerly DONG) was in charge of construction, while a consortium consisting of Danish pension funds PFA and PKA purchased a 50 per cent ownership interest.

As part of the financing, PFA and PKA issued credit-rated project bonds to Aviva Investors, BlackRock Investment Management (UK) Limited, Legal & General Investment Management Real Assets and Macquarie Infrastructure Debt Investment Solutions.

EKF provided a guarantee of just under DKK 3 billion for one of the bond series. The novel aspect of the financing model was that the debt was structured as a green bond where proceeds from the issuance are allocated to the financing of green investments. The bond was indexed to inflation in the UK, which contributes to reducing the financial risks of the project. This was the first time that an offshore wind farm in the UK was financed by a green bond.

”We are world leaders when it comes to public financing of wind farms. We are ready to explore new avenues to ensure successful wind turbine projects as well as to support Danish exports. The solution with a green bond indexed to inflation in the UK is a case in point. At the same time, it is highly satisfactory to be part of a wind partnership that distributes green energy to more than half a million British households,” says Christian Ølgaard, Deputy CEO at EKF.

We are world leaders when it comes to public financing of wind farms. We are ready to explore new avenues to ensure successful wind turbine projects as well as to support Danish exports. The solution with a green bond indexed to inflation in the UK is a case in point.

CHRISTIAN ØLGAARD

Deputy CEO at EKF

| Case facts | |

| What | Offshore wind farm in the UK |

| Owners | Ørsted, PFA, PKA |

| Suppliers | Siemens Gamesa Renewable Energy and MHI Vestas Offshore Wind |

| Size | 659 MW distributed on 87 turbines |

| Construction period | 2015-2018 |

| Total investment | Approx. GBP 2 billion (ownership interest of PFA and PKA) |

| EKF’s share | Approx. GBP 342 million |

| EKF product | Securitisation/Project Financing Guarantee |

A year of several

new initiatives

aimed at Danish exporters

An upturn in the global economy means that private financial institutions have more venture capital. This has somewhat reduced demand for EKF’s financing solutions. Nevertheless, EKF saw some growth in the number of customers in 2017 – most of them small and medium-sized enterprises (SMEs).

In 2017, 254 companies got an export credit, a working capital guarantee or a loan from EKF. This was slightly fewer than the approx. 300 enterprises in 2016. However, current guarantees were issued to 515 enterprises in previous years, bringing EKF’s total number of customers to 769.

630 – or 82 per cent – of the customers belong in the SME segment. This means that EKF welcomed more than 70 new SME customers in 2017 relative to its 564 customers in 2016. One reason for the large increase was that EKF included short-term reinsurance customers in the number for 2017. New guarantees issued to Danish SMEs totalled DKK 1.5 billion.

Development in number of customers in the SME segment

2017 includes short-term reinsurance customers which totalled 58 in 2017.

EKF welcomed 70 new SME customers in 2017, bringing the total number of customers to 630 compared to 564 in 2016.

Working capital, L/C and supplier credit guarantees are popular

As in the preceding years, working capital guarantees were the EKF product most in demand from Danish SMEs. Working capital guarantees accounted for 214 of the 312 export credits, working capital guarantees and loans issued in 2017, corresponding to 69 per cent. With a working capital guarantee from EKF, the banks have the necessary security to offer SMEs credits. The popularity of the working capital guarantees indicates that liquidity and financing of their current capital and operational costs remain the most pronounced needs SMEs have.

L/C guarantees are the second-most-in-demand EKF solution from SMEs. In 41 instances in 2017, an EKF L/C guarantee was the decisive factor in enabling Danish exporters to accept orders from uncertain markets. With an L/C guarantee, exporters will be able to arrange for their bank to participate in payments by letter of credit in countries and in markets where the bank would otherwise be unwilling to accept risk.

In third place, the SME guarantee was overtaken by the supplier credit guarantee as the third-most-in-demand EKF solution from SMEs with 25 guarantees issued in 2017.

Important to ensure awareness of EKF’s services

For Kim Richter, Senior Director, and his SME department at EKF, 2017 was in many ways similar to the previous year. Because of the strong economic upturn in the last couple of years, it has become easier for SMEs to finance their export activities.

”The positive development in the global economy has secured private players more venture capital to finance Danish SMEs, so the enterprises no longer see financing as a bottleneck. This is a positive development for Denmark, as it strengthens the SMEs’ ability to conclude agreements with foreign customers. Even so, we anticipate a slight increase in EKF’s customer numbers in 2018.”

Kim Richter explains:

”Some SMEs in Denmark are still not familiar with EKF’s possibilities of supporting their business development, so we need to keep focusing on our efforts to ensure awareness of EKF’s services. Here, the banks are important partners.”

As part of its ambassador programme in Danish banks, EKF has trained almost 200 advisors in the possibilities of offering their customers export credits. This has led to a good deal of new business, and EKF plans to continue its efforts to train more ambassadors and keep existing ones up to date on new initiatives in 2018.

In addition to its cooperation with banks, EKF’s partnership with company incubators and the Danish Trade Council also plays an important role in ensuring awareness of our services. In 2017, EKF launched several new initiatives to reach even more SMEs, including providing working capital guarantees to tourism companies, shopping lines and leasing guarantees

Some SMEs in Denmark are still not familiar with EKF’s possibilities of supporting their business development, so we need to keep focusing on our efforts to ensure awareness of EKF’s services.

KIM RICHTER

Senior Director, SME and Cleantech, at EKF

Breakdown of customers 2017

SMEs accounted for 82 per cent of EKF’s 769 customers in total at the end of 2017.

Shopping lines, leasing and a helping hand to the tourism sector

2017 saw the introduction of several new EKF initiatives that may help Danish SMEs to reach beyond national borders. For example, the Danish consulate general in São Paulo, the Confederation of Danish Industry, the Danish Agriculture & Food Council and EKF has launched an initiative to make it easier for the agricultural sector and food industry in Brazil to purchase from Danish companies. The huge Brazilian cooperative farms are experiencing rapid growth, and they have a strong appetite for purchasing Danish farm and food equipment.

”We have offered so-called shopping lines to six cooperative farms. By offering them competitive financing, we basically enable them to purchase from Danish suppliers without having to worry about the challenge of financing the purchase,” explains Kim Richter.

In the autumn, EKF was also working on two other offers to Danish SMEs. In November, the rapidly growing tourism sector got a helping hand when EKF provided access to its working capital guarantees. The tourism sector creates growth and jobs in Denmark, and foreign tourists contribute up to DKK 50 billion annually to Danish exports. Many financial institutions in the private market have been reluctant to extend loans to this sector, however. It is dependent on the changeable Danish weather, the season is short, and many Danish tourism companies are located in rural districts.

”Our working capital guarantees enable the tourism companies to implement their business growth plans – provided they are healthy and creditworthy businesses,” Kim Richter points out.

EKF has also developed the Operating Lease Guarantee solution, which was launched in early 2018. The new guarantee enables Danish companies to lease rather than sell their assets to foreign customers, with EKF covering up to 90 per cent of any losses.

EKF is looking forward to monitoring demand for the new products in 2018.

We have offered so-called shopping lines to six cooperative farms. By offering them competitive financing, we basically enable them to purchase from Danish suppliers without having to worry about the challenge of financing the purchase.

KIM RICHTER

Senior Director, SME and Cleantech, at EKF

Form3 Retail winning foreign orders with financing from EKF

Danish Form3 Retail designs and builds attractive shops for well-known brands in both Denmark and abroad. The architectural firm develops approx. 40-50 new projects every year, and thanks to SME guarantees from EKF, they can safely accept more.

Form3 Retail’s principal task is to create unique interior design solutions for the retail industry. You do not just enter a traditional shop, but are guided into a creative universe full of life and all sorts of sense impressions. Everything is carefully selected and adapted. Every detail has been considered.

From conventional production to design

The small firm of interior architects in Kolding, Denmark, has spent many years trying to find its niche and reaching its current level of expertise. In 2010, adversity in the form of increasing e-commerce was what it took for Form3 to find its niche.

”We experienced a sharp fall in demand for the physical shop which was reflected in the number of requests. Rather than seeing this as a limitation, we analysed how we could turn the development to our advantage,” explains Tommy Toft, CEO at Form3 Retail.

”We found out that the need for shops to stand out had suddenly increased compared to previous years. This opened new opportunities for us to offer more holistic solutions that increase the visibility of the customer’s brand. As a result, we stand out from our competitors today, because we are a fully design-based company rather than a conventional production-based company.”

Financing was the key to growth

The development in Form3 really got things going. Today, the Jutland-based architectural firm implements approx. 50 new projects a year and has become a highly attractive partner for major well-known brands from all over the world, including Sand, Marc by Marc Jacobs, DAY Birger et Mikkelsen, Høyer, Levi’s and Paris Hilton.

”Today, our work is not just about interior decoration – it is also very much about branding. We include all aspects and create a holistic experience for our customers,” explains Tommy Toft.

The scope of Form3’s projects has increased in step with their quality.

”Higher quality of a project typically means higher project-related costs and a higher overall budget, and this resulted in growing demand for financing among our customers.”

Form3 quickly realised that they needed to find a solution to the increasing financing requirement if they wanted to take advantage of the wave of growth. They consequently contacted their bank, which presented a financing model based on a SME guarantee from EKF. The SME guarantee enables Form3 to offer customers abroad long-term credit for specific projects. A clever feature is that even though customers are granted a credit, Form3 gets paid right away.

The Jutland-based architectural firm sees this as a win-win situation for all parties and uses the solution on all projects where it makes sense.

”We present EKF’s financing solution to both existing and new customers and explain how we can help to secure financing for their projects, if required. As a result, many projects that used to be merely a dream are now being implemented,” Tommy Toft says in conclusion.

We present EKF’s financing solution to both existing and new customers and explain how we can help to secure financing for their projects, if required. As a result, many projects that used to be merely a dream are now being implemented.

TOMMY TOFT

CEO, Form3 Retail

CSR at EKF

At EKF, we are constantly striving to adapt and streamline our CSR processes. In 2017, our main focus was on environmental and social sustainability. This is a natural consequence of the fact that as an export credit agency, we must comply with a number of international standards applying to all state-owned export credit agencies.

At EKF, it is an absolute requirement that the transactions in which we are involved comply with international standards such as the IFC Performance Standards, the OECD Common Approaches, the OECD Multinational Enterprise Guidelines, the UN Global Compact and the UN Guiding Principles on Human and Business Rights. We are continuously monitoring this, which is also one of the aspects of ‘Prudent growth’.

It is elaborate and time-consuming work, and we are consequently striving to establish a flexible process to ensure that the projects comply with environmental and social sustainability standards. We see to it that environmental and human rights aspects and social sustainability are integral parts of EKF’s initial screenings, risk assessments and regular follow-up. This clearly and unequivocally shows our customers, and often also their customers, how CSR must be integrated in the business.

According to the OECD Common Approaches, projects are classified as category A, B or C projects. The classification indicates the review and assessment processes required for the project. Category A projects require an extensive assessment of environmental and social sustainability, while category B projects are typically smaller, have fewer impacts and therefore do not require the same level of assessment.

In 2017, EKF was involved in six projects classified as category A projects and ten projects classified as category B projects. Around half were wind projects, while five others were agricultural projects.

Read more about EKF’s CSR activities and our obligations with regard to environmental and social sustainability at ekf.dk.

Here you can find more detailed information about the international standards with which EKF must comply and read more about the methods to calculate environmental and social impacts for EKF’s transaction portfolio.

Regular follow-up on transactions

Following up on environmental and social sustainability requirements is just as important as following up on financial conditions. We prioritise both internal resources and consultancy services in order to ensure project compliance with international standards. In 2017, our follow-up activities included:

- Scandinavian Farms pig breeding project in China

- Awash-Weldia – railway project in Ethiopia

- Teghout – copper and molybdenum mine in Armenia

EKF has been involved in Scandinavian Farms’ establishment of a large pig herd in China for several years. In 2017, we visited Scandinavian Farms in China to follow up on employee conditions, slurry handling and animal welfare, among other aspects.

In 2017, construction of the last 100 km stage of the railway project in Ethiopia was started. As in previous years, EKF monitors the project closely, which includes visiting the construction sites as well as the neighbouring local communities.

It is an absolute requirement that the projects comply with international standards, and EKF always does whatever it can to guide the projects in the right direction. However, due to the nature of EKF’s business, very few sanctions are available to us once the loans have been extended and the projects have started. Therefore, if all other options have been exhausted, there is only one ultimate solution: to withdraw the guarantee and require prepayment of the loan.

EKF is involved in approx. 500 export transactions in more than 100 countries. Frequently in countries with other traditions and environmental and social regulations than in Denmark, so compliance with these requirements is a condition for EKF’s participation. In 2017, EKF made the decision to withdraw its financing for a copper mine in Armenia. The decision was reached after multiple attempts over several years to get the mine to comply with the terms of the agreement with EKF. For the first time in EKF’s history, we were compelled to withdraw our financing of a project in progress due to environmental and social impacts.

Consistent application and interpretation of international standards

EKF has long-standing experience with applying and interpreting the international standards that we, like all other export credit agencies, must comply with. We wish to pass on this experience to our international colleagues and partners. Partly to ensure equal terms of competition for Danish companies and partly because we believe that applying international standards is important to ensure responsible growth in connection with export finance. It is a principal element of EKF’s CSR policy.

EKF’s CSR policy also covers environmental and employee conditions for our own business.

Environmental conditions at EKF

EKF’s environmental footprint is moderate, as is the case with most office businesses. The most significant impact is related to energy and water consumption. Waste volume and resource consumption levels are both relatively constant in comparison to previous years.

| WASTE AND RESOURCE CONSUMPTION | 2017+ | 2016 | 2015 | 2014 |

| Waste (tonnes/year) | 22 | 20 | 20 | 22 |

| Electricity consumption (MWh/year) | 244 | 250 | 257 | 265 |

| Heat consumption (MWh/year) | 216 | 216 | 221 | 235 |

| Water consumption (m3/year) | 863 | 863 | 859 | 659 |

| + Not all data was available at the time of reporting. Consequently, data is based partly on estimates and partly on data from previous years. | ||||

The figure below shows EKF’s CO2 emissions related to consumption and transportation. The total contribution of CO2 equivalents for 2017 amounted to 620 tonnes. At 532 tonnes, air travel is by far the largest single contributor, which can be attributed to EKF’ participation in numerous negotiations in relation to our projects around the world.

CO2 emissions associated with EKF’s consumption and transportation

taxi and own car","data":[19],"_colorIndex":0},{"name":"Heat consumption","data":[19],"_colorIndex":1},{"name":"Electricity consumption","data":[50],"_colorIndex":2},{"name":"Air travel","data":[532],"_colorIndex":3}],"xAxis":{"categories":[""],"gridLineColor":"#ddd","title":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"labels":{"style":{"color":"rgba(0, 0, 0, 0)","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"#ffffff","tickColor":"#ffffff","tickInterval":1},"yAxis":{"categories":["0","50","100","150","200","250","300","350","400","450","500","550"],"gridLineColor":"#ddd","gridLineWidth":1,"title":{"text":" Tonnes","style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12}},"opposite":false,"labels":{"style":{"color":"#636362","fontFamily":"Verdana, sans-serif","fontSize":12},"format":"{value}"},"lineColor":"#ffffff","tickColor":"#ffffff","tickInterval":50},"colors":["#009de0","#b2d8f6","#9b9b9b","#007aac","#005475","#c4c5c5"," #4aafe8","#84c4ef","#636362","#e2e2e3"],"title":{"text":" ","align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"subtitle":{"align":"center","style":{"color":"#636362","fontFamily":"Verdana, sans-serif"}},"legend":{"enabled":true,"layout":"vertical","align":"right","verticalAlign":"middle","itemMarginTop":30,"borderWidth":0,"padding":0,"itemStyle":{"color":"#636362","fontWeight":"normal","fontFamily":"Verdana, sans-serif","fontSize":10}},"tooltip":{"enabled":false,"shared":false,"pointFormat":"{series.name}: {point.y}","valueSuffix":" ton","shadow":true,"backgroundColor":"#ffffff","borderColor":"rgba(0, 0, 0, 0)"}}

Employee conditions

EKF is continuously striving to ensure good conditions for our employees. Annual employee satisfaction surveys show that job satisfaction is high. Another focus area in 2017 was safety in relation to official business travel. It is important to us that our employees feel comfortable travelling to the destinations where we conduct business. Accordingly, all business trips must be registered by Control Risk, which provides information on safety conditions in the countries of destination – before and after the trips.

For a number of years, we have undertaken a systematic approach to ensuring that the UN Guiding Principles on Human and Business Rights are incorporated in our business transactions. In 2017, EKF also analysed potential negative impacts on human rights based on EKF’s own activities and employees. This work will continue in 2018. The purpose of the analysis is to point out any human rights issues that are not being specifically handled in order to prevent potential negative impacts.

EKF employees

EKF is a knowledge-intensive institution and the vast majority of our employees have a long-cycle higher education. Skills development is key in ensuring that we are able to meet our customers’ requirements.

At EKF, we want to be known as a financial institution that creates results and is customer-oriented, an institution based on commitment, professionalism and reliability. To that end, we focus on employees to provide the basis for continued successful development of EKF. We invest a significant amount in staff and management development every year. In 2017, our special focus was on targeted courses.

We seek to develop a culture that promotes employee well-being and development and contributes to a financially efficient and quality-driven operation of EKF. We want to provide attractive conditions for our employees and believe that a positive working environment based on employee well-being counteracts absenteeism and ensures dedicated and happy employees.

We wish to attract and retain the best employees to the organisation, and in our experience, interest in working at EKF is high. In 2017, we received approx. 800 job applications and hired 16 new employees. The average number of staff in 2017 was 124. The high number is attributable to the fact that our business has grown substantially in recent years, that complexity has increased and that we are currently assisting more companies than ever before.

Gender balance in EKF’s management

At EKF, we support the principle of equal gender representation in EKF’s supreme governing body, i.e. the Board of Directors. We recognise the need for diversity in management, because we believe this creates the best business results. As an independent public company, we are subject to the provisions of the Danish Gender Equality Act stating that Boards, assemblies of representatives or similar collective management bodies should have an equal gender balance.

Since the proportion of women on EKF’s Board of Directors constitutes 50 per cent (33 per cent excluding members of the Board of Directors elected by the employees) and thus meets the requirement for an equal gender balance, EKF has not set any targets for this.

EKF has a policy on equal gender representation in management. The policy covers all layers of management in the organisation. Women managers at EKF account for 33 per cent of the overall management group. We want to increase the proportion of women managers in our management group, so we encourage women to go for management positions. We do this by striving for a representation of women in the recruitment process for management positions, provided that the candidate meets the qualification requirements. Furthermore, we ensure internally that management positions are discussed with potential women managers as part of the discussion of their career development during performance reviews.

Total number of EKF employees (average)

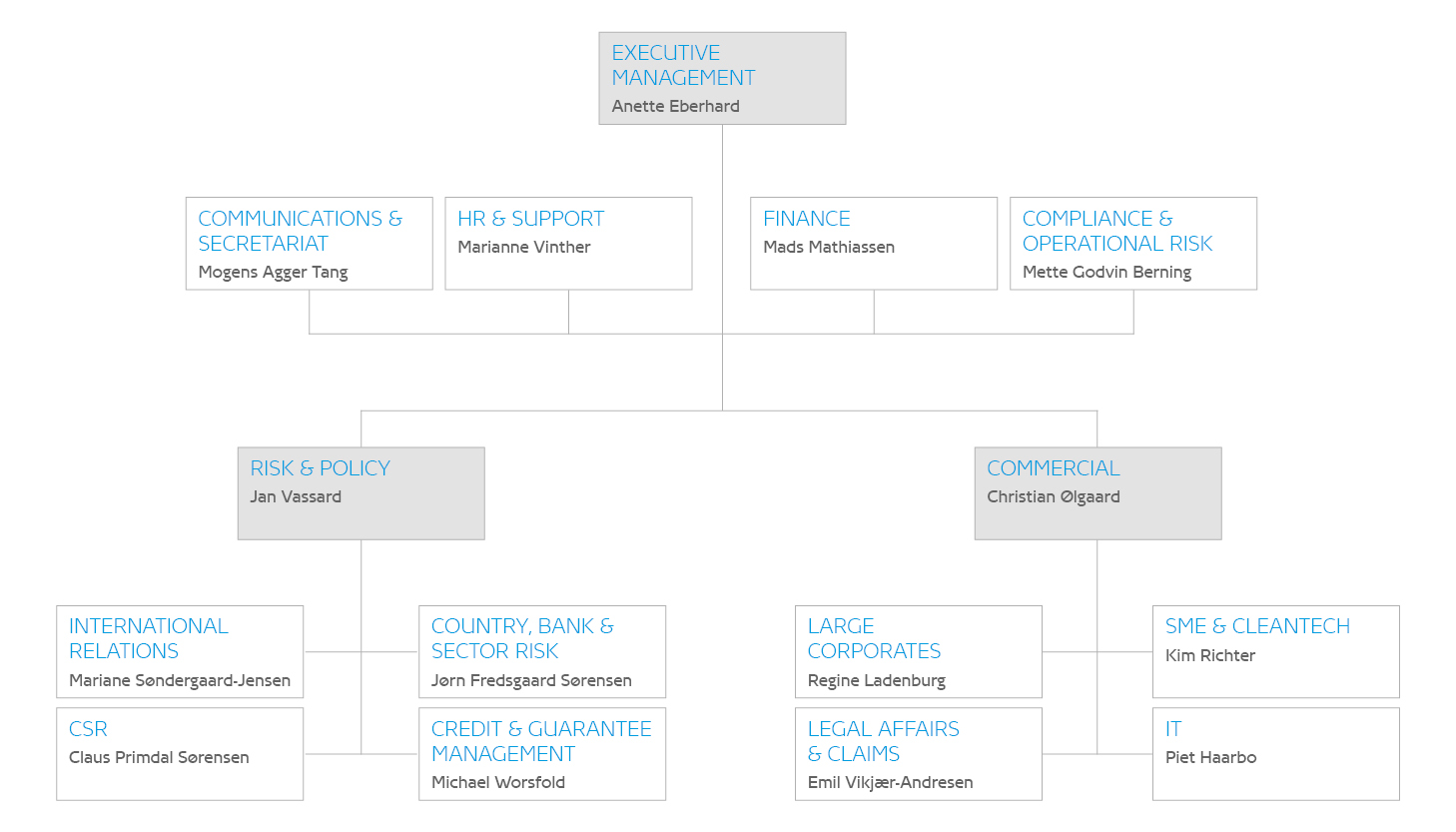

Corporate governance

EKF organises the management of EKF and our activities in accordance with the purpose of EKF as defined in the Act on EKF Denmark’s Export Credit Agency. According to the Act, EKF is to facilitate Danish companies’ export and internationalisation opportunities, participation in the global value chain and cultivation of new markets through internationally competitive financing and risk cover.

As part of this organisation, EKF must follow the recommendations for exercising ownership and corporate governance in state-owned companies as described in the government’s ownership policy for 2015.

The framework for EKF’s activities is laid down in the Act on EKF Denmark’s Export Credit Agency. As EKF has the status of an independent public company, the Danish state through the Ministry of Industry, Business and Financial Affairs has the final power over its activities within the framework of legislation.

EKF’s Board of Directors undertakes the overall and strategic management of EKF and the supervision of Management. The general tasks and responsibilities of the Board of Directors are laid down in its rules of procedure. Management is in charge of the day-to-day management of EKF and must thus comply with the policies, guidelines and instructions provided by the Board of Directors.

The Board of Directors consists of eight members, six appointed by the minister and two elected by the employees. In accordance with the Danish state ownership policy and the corporate governance recommendations, the Board of Directors performs an annual self-assessment. The most recent self-assessment was performed in September 2017.

According to EKF’s articles of association, board meetings are held at least four times a year. Eight board meetings were held in 2017.

The Board of Directors set up two sub-committees in 2017: an Audit and Risk Committee and a Remuneration Committee. In accordance with the Danish state ownership policy, the members of the committees and the committees’ terms of reference can be seen on the EKF website www.ekf.dk.

As laid down in the strategic ownership document for EKF, the chairmanship holds quarterly meetings with the Ministry of Industry, Business and Financial Affairs, presenting a comprehensive and detailed report on EKF’s strategic relations and a follow-up on its operating results etc.

For more information on remuneration and fees, see note 6 to the income statement and the other duties of the Board of Directors in the section entitled ‘EKF’s Board of Directors’.

EKF applies the Danish state ownership policy

As an independent public company, EKF applies the Danish state ownership policy as its corporate governance code. The ownership policy contains a large number of specific recommendations for and expectations of the Danish state’s exercise of ownership and the conduct of state-owned companies.

EKF aims to comply with all recommendations of the state ownership policy. We achieved this aim in 2017.

In accordance with the Danish state ownership policy, EKF notes that EKF’s Board of Directors holds eight annual board meetings.

The state ownership policy is available in Danish at the Ministry of Finance website.

New EKF strategy

Prudent growth

The environment in which EKF operates is constantly changing, so it is important for us to regularly consider how best to support the internationalisation of Danish companies. Against that backdrop, we developed a new strategy for EKF in 2017.

The name of the new strategy is ‘Prudent growth’. With this name, we wish to signal that EKF aims to create growth with our customers and partners – for Denmark. We will achieve this by being bold and accepting risk and by acting responsibly and with care.

The generally increasing risk appetite of banks has a very positive effect on Danish exports. For EKF it means lower demand for our guarantees and loans in local markets and higher demand in high-risk countries. EKF needs to exercise care when taking risks in those countries.

We will work strategically to strengthen the SME segment. This means we must exercise care in terms of our credit ratings, our acceptance criteria and our customer relationships.

Strategy process

EKF developed the new strategy by means of a conventional strategy process, including a thorough analysis of the environment in which we operate and EKF’s previous performance. We relied on the expertise of external consultants who presented their estimate of EKF’s near future in the form of megatrends and the Danish export environment. They also analysed our results, business areas, ratios and internal processes. A benchmark analysis comparing EKF with other export credit agencies based on a number of parameters was also conducted. Finally, approx. 140 of our customers and stakeholders were interviewed in the course of the process.

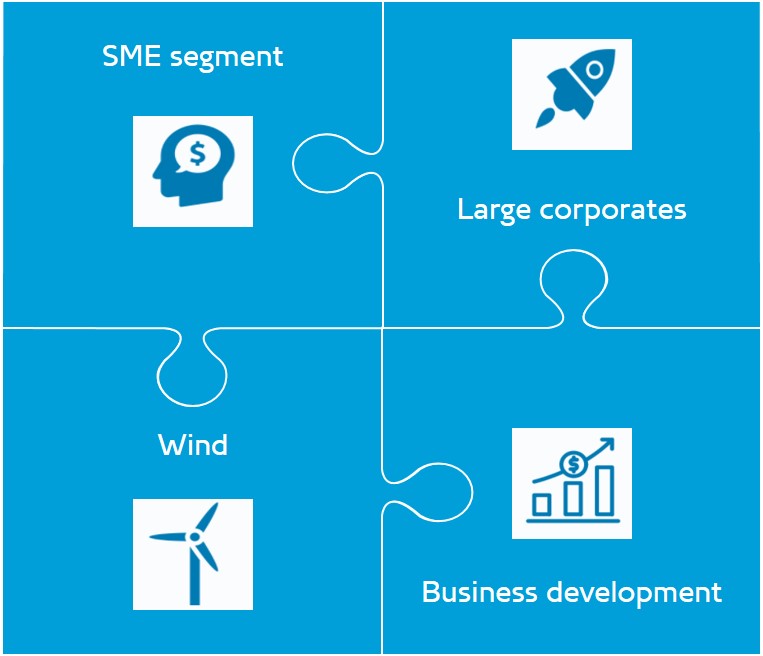

Four must-win battles

The strategy indicates four must-win battles for EKF in the years to come:

| SME segment | EKF will continue to support the internationalisation of Danish SMEs – exercising care by paying more attention to credit. | |

| Large corporates | EKF will achieve more with groups of corporates and single corporates in high-risk markets. | |

| Wind | EKF will help their customers move into new and more distant markets – both onshore and offshore. | |

| Business development | When servicing EKF’s approx. 750 customers, we will focus on: - more and closer relations - more agile business development based on customer input - clear and simpler communication - digitisation |

Strategy work in 2018

In 2018, EKF will also endeavour to set up a number of requirements to ensure a successful roll-out of the strategy:

-

We will conduct outreach activities to get more customers.

-

We will strengthen our dialogue with customers, sponsors and banks.

-

We will increase our site visits in order to physically inspect projects and debtors – before taking on risk.

-

We will focus particularly on IT and digitisation at EKF.

EKF's

risk management

Risk-taking is a cornerstone in EKF’s activities, so risk management is an integral part of EKF’s business model. We work tirelessly to develop and adapt our risk management to the current risk landscape. In 2017, EKF expanded its risk management by a number of initiatives, including a whistleblowing scheme and the establishment of an Audit and Risk Committee.

At EKF, we balance our objective of ensuring that Danish exporters have access to internationally competitive financing by minimising unnecessary losses through adequate and transparent risk management. EKF’s greatest risk is that Danish and international debtors do not have the possibility, ability or willingness to pay the guarantee holder, which is usually a bank. To this may be added the risk of non-repayment of EKF’s export loans.

EKF is exposed to various risk types, and risk management is a significant focus area for our Board of Directors and Management alike. The Board of Directors defines the risk policy and other policies to ensure risk management at EKF. Management is responsible for the implementation of the risk exposure framework in the business and for ongoing risk management and follow-up, including mapping and assessment of the individual risks associated with our business activities. Using internal regulations at EKF, we ensure compliance with the policies adopted by the Board of Directors.

EKF’s overall risk management is vested in the Finance department, which is responsible for the management and control of financial risks. Compliance & Operational Risk is responsible for operational risk management. The departments are jointly responsible for the practical implementation of the decisions made by the Board of Directors and Management in relation to risk management at EKF.

We cooperate with rating agencies and national and international credit insurers with regard to international credit and risk management standards.

Risk management

Credit risk

Credit risk, which is EKF’s greatest risk, occurs when counterparties on EKF-guaranteed loans, working capital guarantees and direct lending default on their debts. EKF manages credit risks via the credit rating framework defined in its credit policy and product-specific guidelines. We apply a number of internal credit risk pointers in connection with export credits, working capital guarantees, loans and conditional offers with a view to evaluating individual new transactions and regularly reassessing the overall portfolio risk. For risk classification of commercial risks, we use internationally recognised tools from Standard & Poor’s to assess foreign debtors and projects. For risk classification of Danish risks, we use a model developed by Moody’s. In our assessment of commercial risks and sector risks, we stress test debtors’ payment ability. Moreover, relevant collateral is included in the overall risk exposure.

Large projects in the construction phase involve supplier risk in case the Danish exporter is unable to deliver the project as agreed. The exporter may issue a counter-guarantee, thereby guaranteeing a form of compensation for foreign buyers. Risks in the construction phase are included in EKF’s overall credit assessment. Project financing transactions in the wind sector are increasingly based on an element of spot prices in the electricity market rather than fixed-price purchase agreements, which makes future cash flows less predictable. We seek to mitigate the higher risk by means of lower leveraging, additional reserves and incentives to increase fixed-price sales using cash sweep mechanisms.

For our assessment of political risks, we use the OECD’s minimum country risk classification, which comprises the factors that may impact debtors’ possibilities, ability and willingness to meet their payment obligations. Developments in the credit rating of relevant banks and countries are continuously monitored.

EKF’s credit risk on swap counterparties occurring in connection with hedging of market risk on lending is restricted by a number of guidelines, since we comply with standards determined by Danmarks Nationalbank concerning ratings and amount sizes as well as stipulation of requirements for Euroclear under CSA agreements.

The figures below show our guarantee exposure broken down by the Standard & Poor’s credit rating categories applied by EKF.

Rating distribution of EKF’s new guarantee exposure and loans

Rating distribution of EKF’s guarantee exposure and loans

at 31 December

New guarantees in 2017 had an average credit quality equivalent to BB- and average maturity of 11.8 years.

EKF undertakes high and long-term credit risks. At 31 December 2017, the average maturity of the entire portfolio was 11.6 years, and the average credit rating was slightly below BB-.

Insurance risk

Insurance risk is the risk that realised losses on EKF’s portfolio of guarantees exceed total provisions and write-downs. Thus, insurance risk expresses a portfolio consideration under which the provisions made do not measure up to potential losses.

Our insurance risk is significant due to major concentration on individual debtors, sectors and regions, but is reduced by a number of initiatives. In accordance with EKF’s articles of association, we have established a concentration reserve, the ‘restricted equity’, which increases in case of a rise in portfolio size and concentration in order to absorb major potential losses. At the end of 2017, our restricted equity totalled DKK 2.4 billion.

One of our risk management tools is monitoring portfolio risks. EKF runs credit rating checks of approx. 60 per cent of our existing portfolio with commercial risks based on principles concerning exposure, estimated probability of loss and customer characteristics. Continuous monitoring helps to ensure that we know the portfolio and the overall risk profile and its development. Moreover, it enables us to implement loss prevention measures and calibration of provisions when required. The portfolio with bank and sovereign risks is monitored by reviewing financial institution ratings and by reviewing regions minimum once a year. Overall, EKF monitors minimum 80 per cent of the portfolio using automated, systematic processes.

At EKF, we use reinsurance in our risk management as well as our business model. EKF’s case-specific reinsurance and EKF’s treaty reinsurance agreement, under which we reinsure significant new guarantees within the given framework, add great value in terms of risk management by addressing large concentrations on debtors and countries in the portfolio. At the same time, EKF is able to increase its capacity through strategic reinsurance based on portfolio segmentation. In 2017, EKF retained a reinsurance level of 20 per cent of EKF’s total exposure.

Hence, in addition to reducing insurance risk, reinsurance also lessens our capital requirements and frees up capacity to issue new guarantees and loans.

Guarantee exposure and loans, excluding reinsurance, by country risk category at 31 December 2017

Market risk

Market risk is the risk of loss or additional expenses due to adverse changes in the financial markets. In terms of market risk, EKF is exposed to interest rate, exchange rate and liquidity risks.

For guarantees, we only hedge exchange rate and interest rate risks in relation to accounting assets and liabilities. Our exchange rate risk is related to the difference, at portfolio level, between our total liabilities (provisions) and assets (premium receivables and claims) in each of the currencies to which we are exposed. The overall accounting effect is reduced, as far as possible, through financial contracts such as forward exchange contracts.

EKF’s principal currency exposure is to the euro, but the fixed exchange rate policy reduces the impact of fluctuations in the euro on our net profit. Based on an assessment of the overall exchange rate risks of our portfolio, the US dollar, the Mexican peso and the pound sterling are currently the only currencies we hedge.

We do not hedge market impacts on the guarantee exposure as the size of provisions reflects EKF’s overall expected loss on the portfolio. In general, the actual credit risk of individual transactions is not affected by changes in exchange rates and interest rates. Where such changes actually affect the credit risk of a transaction, this impact has been stress tested and the risk has been factored into the rating – and thus into the recalculated premium on which our provisions are based.

For export loans, we hedge the interest rate and exchange rate risks that occur when raising loans in Danish kroner at a fixed interest rate and providing loans at a fixed or floating reference rate, typically LIBOR or EURIBOR, in foreign exchange. Using interest rate and currency swaps, EKF ensures a link between the raising of loans under the re-lending scheme and lending to customers. The liquidity risk associated with export loans is due to placement risk, since re-lending is obtained prior to the long payment period of export loans. EKF hedges placement risk by using the repo market, which reflects the drawing profile of export loans through a number of repos.

Our capital requirements are affected by exchange rate and interest rate fluctuations through the size of our guarantee exposure and loans. If our export credit and working capital guarantee exposure and loans increase, so does the capital requirement in terms of the size of our non-restricted equity. Consequently, our scope for issuing new export credits, working capital guarantees and loans changes when exchange rates appreciate or depreciate.

Since the beginning of 2017, EKF has invested part of our free funds in a portfolio of particularly secure securities. The portfolio is classified as ‘held to maturity’ and managed on the basis of the criteria for a positive return and a modified duration of 5.5 years. EKF’s liquidity reserve management is now based on a number of basic principles in its policy for investment of EKF’s free funds setting the limits for operating liquidity, on-demand liquidity and free funds as well as risk management of EKF’s investments. In the event of extraordinarily high indemnification payments, EKF may use bonds in the investment portfolio as collateral in a repo transaction.

Operational risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events, including compliance and reputational risks and legal risks. Operational risk is managed through internal regulations drawn up in order to ensure the best possible control environment at EKF. We seek to minimise operational risk by, for instance, separation of duties between performance and control of activities and by an authorisation structure.

Compliance risks are managed by Compliance & Operational Risk that holds overall responsibility for continuous implementation and maintenance of efficient processes to ensure that EKF meets its obligations in accordance with relevant national and international regulations and relevant standards. Compliance & Operational Risk reports directly to the EKF CEO.

Financial

review

Income statement

EKF’s total net profit for 2017 was DKK 598 million. This is an improvement on 2016 when the net profit was DKK 467 million. The profit for 2017 is highly satisfactory, enabling EKF to distribute DKK 140 million to the Danish state for 2017. As expected, EKF achieved a positive result for 2017. Demand for export credits, working capital guarantees and loans was relatively high, but the number of new guarantees issued was lower than expected. In 2017, an increase in the risk appetite of private entities in the market reduced demand for EKF’s participation in a number of transactions. It also reduced demand for export loans as the capital markets were highly liquid. As expected, a relatively large part of the new issues were wind project guarantees, and in terms of new issues in Ethiopia and Mali, among other countries, EKF also saw Danish exporters turning to more high-risk markets.

Despite a fall in issues of new export credits, working capital guarantees and loans from 2016 to 2017, net profit for 2017 was higher than for 2016. EKF has a large portfolio of transactions issued in previous years for which reductions in guarantee provisions and interest income on loans are regularly recognised as income. At the same time, there was no need to make provisions or write-downs for any large new non-performing guarantees or loans in 2017. In 2014, EKF made large provisions due to the situation in Ukraine. EKF contributed to the reconstruction of a large project in Ukraine, meaning that a considerable proportion amounting to DKK 104 million of the provisions made for claims expenses could be recognised as income in 2017.

Following the upturn in the financial market, a number of large guarantees were redeemed ahead of time in 2017, while a few guarantees were refinanced. As a result, EKF was able to reverse substantial premiums in 2017 and to recognise the related guarantee provisions as income.

| DKK MILLION | 2017 |

| Reversed premiums etc. | -456 |

| Reversed reinsurance premiums | 193 |

| Change in guarantee provisions | 449 |

| Change in the reinsurance share of guarantee provisions | -213 |

| Premium income for own account | -27 |

| Commission to and from reinsurance companies | -29 |

| Net financials | -62 |

| Net effect of prepayments and refinancing | -118 |

Profit is an important contribution to our non-restricted equity, which is significant in terms of our capacity to issue new export credits, working capital guarantees and loans in the years ahead. EKF expects to distribute DKK 140 million on approval of the Annual Report for 2017. Moreover, EKF allocates part of the profit to the restricted equity, which may be used in case of major claims.

Insurance

The technical result before administrative expenses amounted to DKK 553 million in 2017. This is a significant improvement on the 2016 result, which amounted to DKK 269 million. The technical result consists of premium income for own account of DKK 550 million, claims expenses for own account of DKK 19 million and commission to and from reinsurance companies of DKK 22 million. The higher technical result before administrative expenses is mainly attributable to the low level of claims expenses in 2017.

Gross premiums amounted to DKK 890 million, which is a decrease of DKK 312 million compared to 2016. The decrease in gross premiums in 2017 is mainly attributable to a lower level of export credits and working capital guarantees in 2017 compared to 2016. In 2017, EKF issued new export credits, working capital guarantees and loans totalling DKK 11.5 billion, or DKK 2.4 billion below the amount in 2016 when new issues amounted to DKK 13.9 billion. Reinsurance premiums paid represented an expense of DKK 179 million in 2017. The premiums paid to reinsurance companies for guarantees issued in 2017 represented an expense of DKK 372 million in 2017. As a result of prepayments and refinancing, EKF was able to recognise DKK 193 million as income in the form of reversed reinsurance premiums.

EKF had a treaty reinsurance agreement with the private reinsurance market for 2017, under which all major projects were automatically reinsured within the agreed framework. Our reinsurance led to a reduction in EKF’s exposure and thus a fall in related guarantee provisions.

Changes in guarantee provisions represented an income of DKK 257 million. Due to new issues of export credits and working capital guarantees, EKF made provisions of DKK 730 million. In 2017, as underlying loans guaranteed by EKF were gradually repaid, we were able to recognise as income DKK 420 million in reductions in previous years’ provisions for guarantees. As a result of prepayments and refinancing of projects in 2017, EKF was able to recognise guarantee provisions of DKK 449 million as income. Provisions corresponding to DKK 47 million were reversed in relation to projects that had run into difficulties. Other effects such as adjustments of guarantees and adjustments to country and debtor risk classifications returned a total income of DKK 71 million.

Claims for 2017 were substantially lower than in 2016. Claims expenses for own account amounted to DKK 19 million, net, which was DKK 342 million lower than in 2016. There were no new major transactions in 2017 for which it was necessary to make provisions. Indemnification payments were mainly related to a few medium-sized transactions abroad and minor losses on working capital guarantees and other products issued to Danish small and medium-sized enterprises. In 2017, EKF recognised as income a share of the provisions previously made on a major project in Ukraine. As the project is reinsured, the share of the provisions related to the reinsurance was charged to the income statement in 2017.

Commission to and from reinsurance companies came to a net income of DKK 22 million. The income is ascribable to the administration commission EKF charges on reinsured transactions.

Lending activities

The result of lending activities before administrative expenses was DKK 259 million. This was a decrease on 2016 when the profit was DKK 331 million. The decrease is mainly due to fluctuations in unrealised value adjustments.

Under EKF’s business model for lending activities, EKF raises re-lending at Danmarks Nationalbank, on-lending it for export transactions. This involves considerable market risks, since re-lending is raised in Danish kroner at a fixed rate, while loans for export transactions are raised in different currencies at floating rates. EKF hedges the market risks occurring in this connection by interest rate and currency swaps. As a result, EKF will receive the full margin concerning loans expressed in the line Financial income related to loans, which are then converted into interest rate and currency swaps and repaid to Danmarks Nationalbank as a fixed interest rate in the line Financial expenses related to loans. So, to assess the income related to EKF’s lending activities, basic earnings, financial income and financial expenses should be taken as one.

Basic earnings from lending activities amounted to DKK 275 million in 2017 against DKK 317 million in 2016. The primary reason for the decrease is a reduction in the portfolio of loans as a result of repayments.

No objective indications of impairment of new loans were registered in 2017 compared to the previous year. As no further impairment of already impaired loans was registered either, the expense was DKK 0 million in 2017.

Value adjustments, unrealised, represented an income of DKK 7 million. The income is related to the fact that EKF’s loans are measured at amortised cost, while hedging of market risks is measured at fair value. In 2016, EKF had an income of DKK 118 million as a result of a development in the yield curves (OIS curves) for the US and Australian dollar. While this development affected the market value of EKF’s currency swaps, its loans were not similarly affected, as they are not measured at fair value (accounting mismatch). Fluctuations in unrealised value adjustments are collected in a reserve under equity. Over time, this reserve will be reduced to zero in step with lending, re-lending and derivative financial instruments approaching maturity.

Administration

Net administrative expenses totalled DKK 179 million, up DKK 5 million relative to 2016. The rise is mainly attributable to consultancy fees related to a new strategy for EKF.

Investment income

Investment income represented an expense of DKK 35 million compared to an income of DKK 41 million in 2016.

Total financial income was DKK 52 million in 2017. In 2016, financial income amounted to DKK 192 million. The income in 2017 was related to interest from securities and claims. In 2016, EKF posted a large income from discounting of premiums receivable as a result of falling interest rates.